The 50/30/20 Budget Rule

Budgeting doesn’t have to be complicated. One of the simplest and most effective methods is the 50/30/20 rule. It gives you a clear roadmap to manage your money without feeling overwhelmed. Let’s break it down step by step with real-life examples. Firstly, we understand what the 50/30/20 rule is.

What is the 50/30/20 rule?

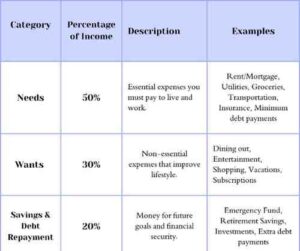

The 50/30/20 rule is a budgeting method that divides your after-tax income into three categories:

- 50% Needs → Essential expenses you can’t avoid (rent, groceries, utilities, transportation, minimum debt payments, insurance).

- 30% Wants → Lifestyle choices that make life enjoyable (dining out, entertainment, shopping, vacations, subscriptions).

- 20% Savings & Debt Repayment → Financial goals (emergency fund, retirement, investments, extra loan payments, big future purchases).

This method was popularized by U.S. Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan, and it has since become one of the most widely used beginner-friendly budgeting systems.

Here’s a clean table that explains the 50/30/20 budgeting rule in a simple way:

Why It Works Well for Beginners

Many people give up on budgeting because it feels restrictive or too detailed, but I think if we stick to budgeting, it is really helpful for us to maintain balance. The 50/30/20 rule works because:

- Simple Framework – You only track three categories instead of dozens.

- Balance Between Life & Money—It allows both responsible saving and guilt-free spending.

- Flexible—works for different income levels and can be adjusted as your lifestyle changes.

- Focus on Priorities—Ensures you’re not overspending on wants while ignoring savings.

For beginners, this rule creates a healthy financial foundation without the stress of complicated spreadsheets. It’s also a great way to spot problem areas—if you’re spending 60% on needs, you instantly know housing or transportation might be eating too much of your income.

How My Friend Jennie Chris Fixed His Money Problems with the 50/30/20 Rule

We all go through phases where money feels like it controls us instead of the other way around. My friend Jennie Chris experienced this first-hand. For months, he was earning a steady paycheck but still struggling. By the end of each month, his bank account was almost empty, and he often had no idea where his money had gone.

Jennie shared with me how stressful it felt. He was paying his bills, but then unexpected expenses came up—a car repair, a medical bill, or just extra spending on things he didn’t track. Slowly, the pressure started building. He even told me once, “I make enough money, but it feels like I’m always broke.”

That bad experience became his wake-up call. He realized he needed to take control of his money before it controlled him. After doing some research and talking to a few friends, Jennie decided to try something simple: the 50/30/20 budget rule.

Jennie’s Budget Journey with $3,000/Month

Jennie earns around $3,000 after taxes every month, and the 50/30/20 rule gave him a clear structure to follow. Instead of guessing or trying to track dozens of categories, he divided his money into just three groups: needs, wants, and savings/debt.

Here’s how his budget looks now:

Needs (50% → $1,500)

This covers the essentials that Jennie can’t avoid:

- Rent/Mortgage: $1,000

- Groceries: $300

- Utilities, Insurance & Transportation: $200

Before, these costs used to feel overwhelming, but now he sets aside the right amount so he never falls behind.

Wants (30% → $900)

Jennie didn’t want to cut out the fun in life, and with this plan, he doesn’t have to. He allocates:

- Dining Out & Entertainment: $300

- Shopping & Subscriptions: $250

- Travel Fund: $350

This way, he can still enjoy dinners with friends, keep his Netflix subscription, and even save for vacations—without guilt.

Savings & Debt (20% → $600)

This is the category that changed everything for Jennie, because before, he rarely saved. Now, he puts away:

- Emergency Fund: $200

- Retirement/Investments: $250

- Extra Loan Payments: $150

By doing this, he’s building financial security. When unexpected expenses come up now, he doesn’t panic—his emergency fund has his back.

From Stress to Balance

Jennie admitted that, at first, sticking to the percentages took discipline. He had to say “no” to a few impulse purchases, and he learned to plan ahead for bigger expenses. But within just a few months, he noticed a huge difference.

- He no longer runs out of money at the end of the month.

- He actually has savings growing for the first time.

- He can enjoy eating out or traveling without feeling guilty.

Most importantly, Jennie says he feels balanced—like his money finally has a purpose.

What I learned from Jennie’s experience is that budgeting isn’t about restriction—it’s about direction. His bad experiences taught him that ignoring money leads to stress, while following a simple system like the 50/30/20 rule can bring freedom and peace of mind.

If Jennie can turn his finances around with this approach, anyone can. It’s not about how much you make, but how you manage what you have.

Adjusting for Higher or Lower Income

The beauty of the 50/30/20 rule is its flexibility. Depending on your income, you may need to tweak the percentages.

- If you earn less:

Your needs (rent, food, utilities) may take up more than 50%. That’s okay—start by cutting back on wants and aim to save at least 10–15% until your income grows. - If you earn more:

Your needs may take up less than 50%. This gives you the opportunity to save more aggressively (25–30% or even higher) while still enjoying a comfortable lifestyle. - If you have debt:

Consider putting more into the savings/debt category (maybe 25–30%) until your balances are under control.

The key is to use the 50/30/20 rule as a guide, not a rigid law. Everyone’s financial situation is different, so adapt it to fit your goals. Over time, as your income rises, try increasing your savings percentage—this small adjustment can have a huge impact on your future wealth.

In my opinion

The 50/30/20 rule is a great starting point, but don’t stop there. Once you’re comfortable, you can explore other budgeting strategies (like zero-based budgeting or cash envelope systems) to fine-tune your finances. The most important step is to start today—because every dollar you manage wisely brings you closer to financial freedom.